- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Information Technology

- By Omega Team

Workflow Automation refers to the design, execution, and automation of processes based on workflow rules where human tasks, data or files are routed between people or systems based on pre-defined business rules.

Workflow automation means streaming the flow of your information. With new technologies and applications integrated with your current working environment, the ultimate goal is to reduce costs, minimize risk and improve customer satisfaction.

Automated workflows can be planned and designed visually by dragging and dropping interface to add and arrange tasks. The process is usually illustrated in a static format and reviewed by all stakeholders for accuracy. Once the static design is finalized, work begins on designing the actual process including forms, tasks, recipients, alerts/notifications, etc. This is done using workflow automation software that includes pre-built tasks that can be arranged and connected as needed.

Automated Accounting and Finance Workflows

Basic financial workflows include:

Purchasing Management: Purchasing management workflow is a process that outlines the important stages for a potential purchase within a business. It enables organizations to tightly control and manage their procurement system.

Accounts Payable: The accounts payable workflow is a company’s complete end-to-end process in the procurement and payment of transactions. It maps the steps from the point at which goods are received to the point at which invoices are paid.

Billing and Accounts Receivable: Billing and accounts receivable refers to the outstanding invoices a company has, or the money it is owed from its clients. It represents a line of credit extended by a company, due within a relatively short time frame, which could range from a few days to a year.

Inventory Management: Inventory flow is the that businesses use to regulate product activity within their operations. It includes the processes from manufacturers sourcing raw materials to retailers stocking finished goods.

ACH/Wire Requests: Automated Clearing House (ACH) and wire transfers payments are electronic fund transfers between banks. ACH is cost effective and preferred over wire transfers. Time and cost can be saved with automated billing and invoicing.

Expense reimbursement: Expense reimbursement workflow enables employees to submit expense reimbursement requests via the web.

End of month reporting: End of month reporting is crucial to getting a detailed and accurate picture of a company’s transactions for the period of time. Companies carry out month-end reports in order to make sure that all transactions have been recorded properly and without accounting errors, from revenues and expenditures to load payments. In large enterprises, this involves a significant amount of risk management.

Employee Operations: Operation workflows define the business processes for managing account, user, and business partner user entities. Employee operation workflow can let employees work and collaborate where and how they want, improving productivity and agility.

Fixed asset management: Fixed Asset management is process to acquire the asset and after maintaining and depreciating for useful life ends with the final disposal of the fixed asset.

Business processes can be tedious, and if done incorrectly, they leave too much room for error. If a business doesn’t have optimized workflows, staff members spend too much time performing data entry and stressing over remaining compliant. Accounting relies on effective workflows to streamline tasks and economic processes to increase productivity. Mobile technology brought on a massive boost to overall finance and accounting productivity. Tasks typically assigned to accounting could now be automated or decentralized across the organization and performed by non-accountants, and in most cases, by anyone with a mobile phone.

More than 1.3 million people are employed in accounting functions, with a little over 650,000 registered CPAs. By volume alone, the industry is in dire need of efficient solutions and pre-accounting and pre-compliance process are no exception. The amount of time accountants spend at work is precious, and every second of billable time you can divert from manual tasks to more strategic objectives is valuable. It’s time to embrace the next era in the evolution of accounting.

Benefits of Financial Flows Automation

Increase efficiency

Financial workflows can help you minimize unnecessary steps or redundancies for the core financial processes such as bookkeeping, invoicing, tax compliance, payroll and expense management. By having more insight into your business and the processes, you can get a better picture of what is necessary and where you can “tighten up”.

Make Bookkeeping easy

Bookkeeping is the process recording, classifying and organizing all financial transactions made by business operations. Automating your bookkeeping can prevent you from spending hours on verifying purchases.

Compliance

It is important for organizations to keep an eye on what are the regulatory changes and how do they affect you. Implementing changing regulations can be labor intensive and put your business at high risk of human errors. Automating financial workflows can reduce the risk of regulatory guidelines breaches, track review/sign off procedures more efficiently and keep on top of deadlines — never miss an expiry date again.

Forecast Future

Budgeting and forecasting have a lot of moving parts, which means keeping your contributors aligned is important. A proper financial workflow management allows you to better forecast and prepare for the future by understanding your current financial position. It can give you information such as what you should be spending and what you can afford to spend. Automating manual data entries can enable you spend more time on analysis.

How to automate your finance workflows

Step 1. Standardize Your Financial Processes

Sketch out the workflow to see where you need to make changes and streamline tasks. It is also important to communicate with stakeholders for their perspectives on improving the process.

Step 2. Create a Digital Form and Workflow

Build the perfect form to capture all the important information you need. You can customize it to make it even more useful for your team. Then, create the finance workflow, keeping in mind conditional tasks, sequencing, and how to dynamically assign people to different tasks.

Step 3. Integrate with Other Software

Once you’ve automated the different financial processes, you need to ensure that your systems are communicating and sharing information with each other. Select tools that can be easily integrated; sometimes a third-party application, like Zapier, can help you with connecting these different tools.

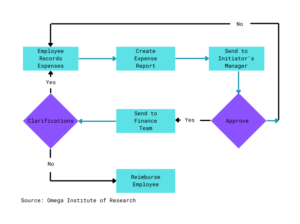

Figure 1: Finance Process Flow

Subscribe

Select topics and stay current with our latest insights

- Functions