- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Technology

- By Omega Team

Introduction

Autonomous vehicle (AV) or self-driving vehicle is a vehicle that is capable of sensing its environment and moving safely with little or no human input. Self-driving technology is receiving the attention of the public as well as vast investments.

Investments

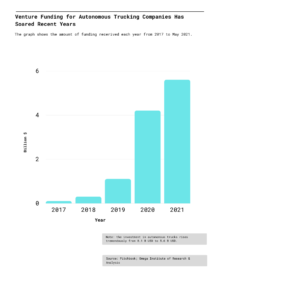

If self-driving vehicles are going to happen, trucks will likely arrive before cars. Investors have poured $11 billion into autonomous truck startups in the past two and a half years, more than $5 billion of that in the first five months of this year alone, according to the data and research company PitchBook. The investor enthusiasm for self-driving trucks reflects a view that the business case may be more appealing than that for self-driving cars, which companies have said will make their debut as robotic ride-hail vehicles. Traditional truck makers and carriers are signing deals with tech companies, signaling optimism in the self-driving future. And the pandemic has just shown how vital trucking and logistics are to the economy.

Exhibit 1: Venture Funding for Autonomous Trucking Companies Has Soared Recent Years

Technology

Both autonomous cars and autonomous trucks rely on similar underlying technology: Sensors—typically cameras, lidars, and radars—feed data to a computer, which in turn controls the vehicle using skills learned through a massive amount of training and simulation. In principle, developing an autonomous truck can be easier than developing an autonomous car, because, unlike passenger vehicles, trucks—in particular long-haul tractor-trailers—generally follow fixed routes and spend most of their time on highways that are more predictable and easier to navigate than surface streets. Trucks are also a better platform for autonomy, with their large size providing more power for computers and an improved field of view for sensors, which can be mounted higher off the ground.

Levels of Driving Automation

Driving automation is rated on a scale of 0 to 5 on six levels. The self-driving trucks being tested today are in level 4. These trucks are capable of performing all driving functions under certain conditions, but drivers still need to take control if necessary. Trucks will be fully automated after SAE Level 5 in the near future.

Exhibit 2: SAE Levels of Driving Automation

Impact on the Industry

There are some facts about the cost, efficiency and more of self-driving trucks that drivers, investors and managers need to know.

The market for self-driving trucks could be squeezed by factors such as higher barriers to entry. Class 8 trucking has a low barrier of entry for now, but when the autonomous trucks are on the road, small and mid-size fleets may not have the capital to invest in these trucks and lack the technology to support the operation.

Running an automated fleet undoubtedly costs more at the beginning, but what about the efficiency it brings and how can it bring profits? How does it change employment in the industry?

According to Criss Wilson, a data scientist at McLeod Software, a provider of transportation management software for carriers and freight brokers, fleets can realistically get 80,000 to 90,000 paid miles a year from each truck with a solo driver, while with the autonomous trucks, it can rise to 200,000 to 300,000 productive miles a year. With this gain in productivity, a fleet could quickly recover the added costs of self-driving technology, which he estimates to be anywhere from $30,000 to $100,000.

At 200,000 miles per year, a truck’s fixed operating costs (interest, insurance, licensing, permitting, etc.) will effectively be cut in half. When variable costs are added, fleets can expect to see a 25% reduction in their overall cost per mile. With the additional revenue on those miles, trucking could be very profitable.

Regarding the concerns that autonomous trucks will put drivers out of work or decrease their pay, Wilson expects the opposite will happen. Drivers will earn significantly more pay from being compensated on all miles they run when behind the wheel or off duty. If a fleet pays $0.60 per mile, for example, a driver could make $120,000 a year by running 200,000 miles. A pay hike of this magnitude would immediately solve a fleet’s driver recruiting and retention problem.

Who are the Major Players?

Many well-known companies are involved in the development of self-driving trucks. Uber made history in 2016 with the first automated truck delivery, but they have announced to stop the self-driving program and to focus more on self-driving cars. However, many companies are continuing to invest time and money in this field.

Daimler

Daimler is the parent company of Mercedes-Benz and Freightliner Trucks. They has been testing their automated truck since 2014. Daimler is focusing on a combination of things including truck platooning and having a driver for safety while exiting the highway. Daimler plans to launch a fully automated truck research center in Portland, Oregon.Waymo

Waymo is a subsidiary of Google’s parent company, Alphabet. Waymo has been testing their trucks for more than a year in California and Arizona. In March, they launched trucks in Atlanta to deliver freight to different Google data centers. Each truck is equipped with a radar system to navigate the roads and a human driver in case of an emergency.Tesla

Tesla first released its truck in November of 2017. Tesla’s trucks will focus on autopilot self-driving software similar to their cars. Tesla’s autopilot is a semi-autonomous system where the acceleration, braking, and steering is controlled by a computer, with a human still at the wheel at all times. Tesla’s goal is to launch a platooning feature where automated trucks follow a single lead truck that is controlled by a driver.Embark

Embark was founded in 2016 in San Francisco. It is assembling a world-class group of engineers from companies like Tesla, Google, Audi and NASA with a professional operations team that averages over a million miles per driver. Their approach is to allow truck drivers to spend less time actually driving, which will allow them to deliver more day by day. They are working on achieving this by automating the driving process on the highway, where most of the time is spent, and letting a driver take over when they get off an exit. Embark is testing their trucks between El Paso, Texas and Palm Springs, California.TuSimple

TuSimple is a company based in Beijing, China and San Diego, California. They also have a testing facility in Tucson, Arizona, where their trucks have driven over 15,000 miles. The trucks are actually based on camera technology rather than laser-based radar, which is what most automated trucks and cars use. The company claims that this is more efficient in detecting things on the freeway, and it is cheaper than radar technology. TuSimple is developing a commercial-ready Level 4 (SAE) fully autonomous driving solution for the logistics industry. The company is driven by a mission to increase safety, decrease transportation costs, and reduce carbon emissions.Conclusion

Autonomous driving is a technology that is constantly improving. From complete human dependence to the autonomous systems that can handle all kinds of conditions, it went through 5 stages. Compared with autonomous cars, the development and popularization of autonomous trucks have more advantages, and investment in these projects has increased exponentially after 2018. For the logistics industry, although autonomous trucks require higher costs and technical requirements, there is no doubt that they can greatly improve efficiency and productivity, and bring more income to drivers.

Subscribe

Select topics and stay current with our latest insights

- Functions