- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Technology

- By Omega Team

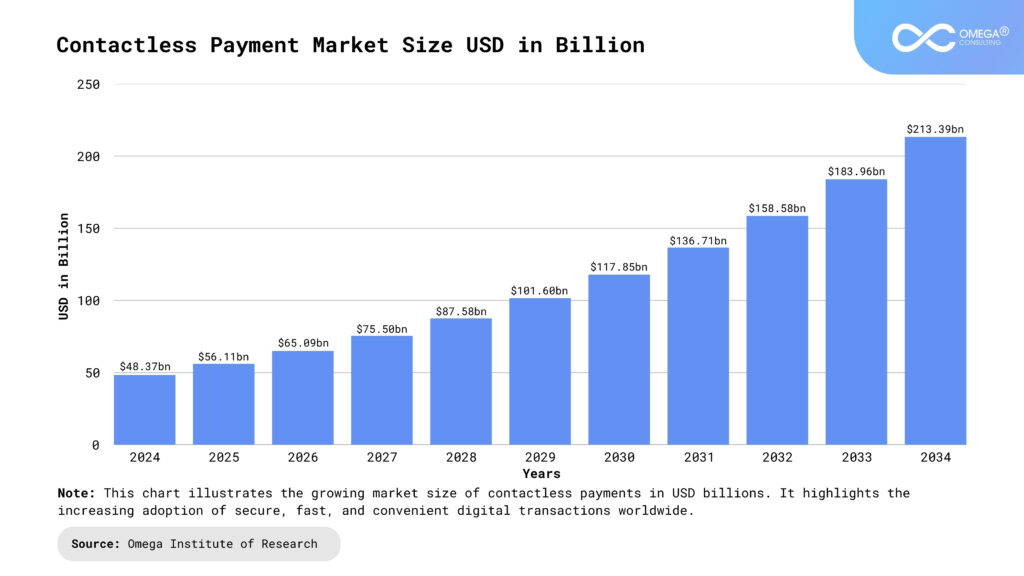

In a world that is rapidly evolving toward seamless, efficient, and secure transactions, the emergence of contactless solutions and digital payments has revolutionized how we handle money, shifting traditional financial interactions toward a more agile and technologically driven future. With an increasing preference for convenience, speed, and enhanced security, these innovations are not just passing trends but fundamental shifts that are actively reshaping the global economy, influencing everything from consumer behavior to business strategies. The widespread adoption of contactless payments is transforming the way people conduct transactions, reducing dependency on cash, and streamlining financial processes across industries, making payments faster, safer, and more accessible. In this article, we will explore the impact of digital payments, examining how they are redefining financial ecosystems, driving financial inclusion, and establishing themselves as the preferred transaction method for both consumers and businesses worldwide.

The Rise of Contactless Solutions

Contactless payment technology, which enables consumers to make payments by simply tapping their card, smartphone, or wearable device, has been steadily gaining traction across the world. As digital transformation accelerates across industries, businesses are recognizing the need to adopt frictionless payment methods to meet evolving consumer expectations. But what makes this solution so appealing, and why is it becoming the preferred choice for millions of users worldwide?

Speed and Convenience: In a fast-paced world, time is of the essence. Contactless payments provide a quick and hassle-free way to complete transactions, eliminating the need for lengthy interactions at checkout. Instead of fumbling with cash, counting change, or swiping a card through a terminal, users can simply tap their card or smartphone near a payment reader. This process takes mere seconds, making it ideal for busy consumers who value efficiency and businesses looking to optimize checkout processes. Additionally, contactless payments reduce wait times at high-traffic locations such as grocery stores, restaurants, and public transportation, enhancing the overall customer experience.

Health and Safety Considerations: The COVID-19 pandemic accelerated the adoption of contactless solutions as people sought ways to minimize physical contact during transactions. Even beyond the pandemic, the preference for contactless payments remains strong, as consumers continue to prioritize hygiene and safety. By eliminating the need for handling cash, signing receipts, or touching payment terminals, contactless payments help reduce the risk of spreading germs, making them a safer option for both consumers and businesses. Moreover, the increasing availability of touch-free checkout options, such as QR code payments and biometric authentication, further enhances security while maintaining a seamless transaction process.

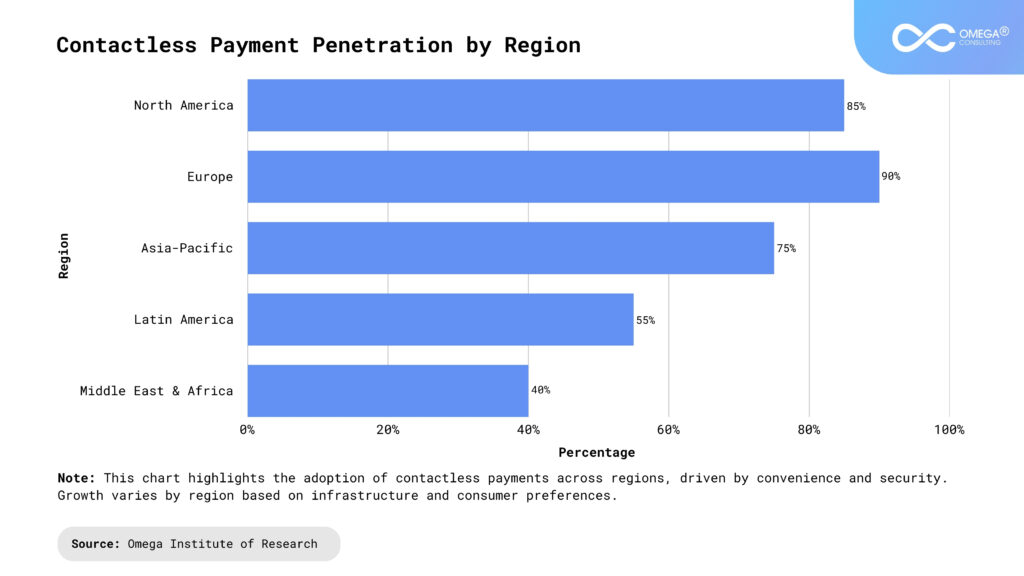

Global Adoption and Interoperability: Contactless payments have grown in popularity around the globe, with widespread adoption spanning multiple industries and regions. From North America to Europe and Asia, this method is increasingly accepted in retail stores, restaurants, public transportation systems, and even small businesses looking to modernize their operations. Many contactless payment solutions are designed to work across different platforms, ensuring interoperability and ease of use for consumers, regardless of where they are. Furthermore, advancements in financial technology, such as blockchain-based payments and cross-border digital wallets, are expanding the reach of contactless transactions, making them a truly global phenomenon.

The Shift to Digital Payments

While contactless payments are a prominent feature of the digital payment landscape, the broader shift to digital payments has been driven by a range of technological advancements and changing consumer behaviors. The rise of fintech innovations, improved internet connectivity, and the growing demand for seamless transactions have accelerated the adoption of digital payments worldwide. As businesses and consumers alike embrace this shift, the financial ecosystem continues to evolve, offering more secure, efficient, and user-friendly payment solutions.

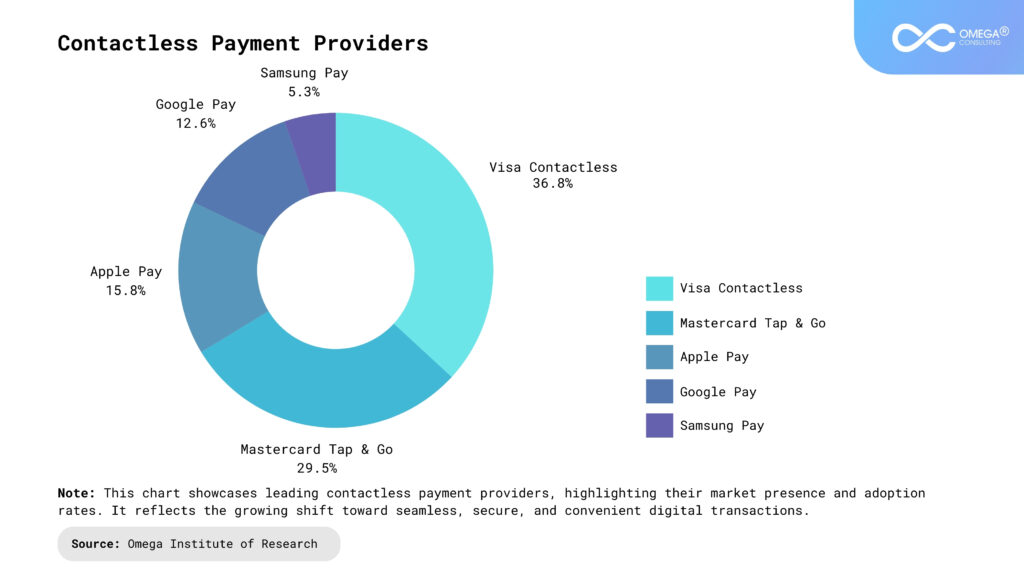

Mobile Wallets and Apps: Smartphones have become a central hub for financial transactions, revolutionizing the way people pay for goods and services. Digital wallets like Apple Pay, Google Pay, and Samsung Pay allow users to store payment information securely on their devices and make transactions with just a tap. With built-in encryption and biometric security features like fingerprint recognition and facial authentication, these wallets offer enhanced protection while maintaining convenience. Additionally, the integration of loyalty programs, digital receipts, and seamless compatibility with wearable devices has further increased their appeal, making mobile wallets an essential part of modern digital payments.

E-commerce Growth: As online shopping continues to soar, digital payments are at the heart of e-commerce transactions, enabling a frictionless purchasing experience. Consumers increasingly prefer the ability to pay via debit or credit cards, mobile wallets, or other digital solutions when purchasing goods and services, driving demand for secure and flexible payment options. This preference has led to a greater push for digital payment innovations, such as one-click checkouts, buy-now-pay-later (BNPL) services, and cryptocurrency transactions. Additionally, the growing adoption of artificial intelligence (AI) and machine learning in fraud detection has strengthened security measures, ensuring safer e-commerce transactions for both businesses and consumers.

Peer-to-Peer (P2P) Payments: Peer-to-peer payment platforms such as Venmo, PayPal, and Cash App have become a go-to option for transferring money between individuals, offering instant, hassle-free transactions. These platforms not only make sending money to friends and family easier, but they also facilitate the payment of services, bills, and even small businesses looking for convenient payment alternatives. The rise of P2P payments is a testament to the increasing shift away from traditional banking methods, as consumers seek faster, more accessible financial solutions. Additionally, the integration of social features, such as transaction memos, emojis, and shared payment histories, has made digital transactions more interactive and engaging, further cementing their popularity in the digital economy.

The Role of Artificial Intelligence and Machine Learning in Digital Payments

As digital payments continue to grow, artificial intelligence (AI) and machine learning (ML) are playing a crucial role in enhancing both security and efficiency. These technologies are not just streamlining transaction processing but also contributing to fraud prevention and customer experience optimization. By leveraging AI-driven insights, financial institutions and payment providers can anticipate trends, adapt to evolving threats, and deliver seamless, intelligent payment experiences. As digital transactions become more complex and voluminous, AI and ML are ensuring that the financial ecosystem remains resilient, secure, and customer-friendly.

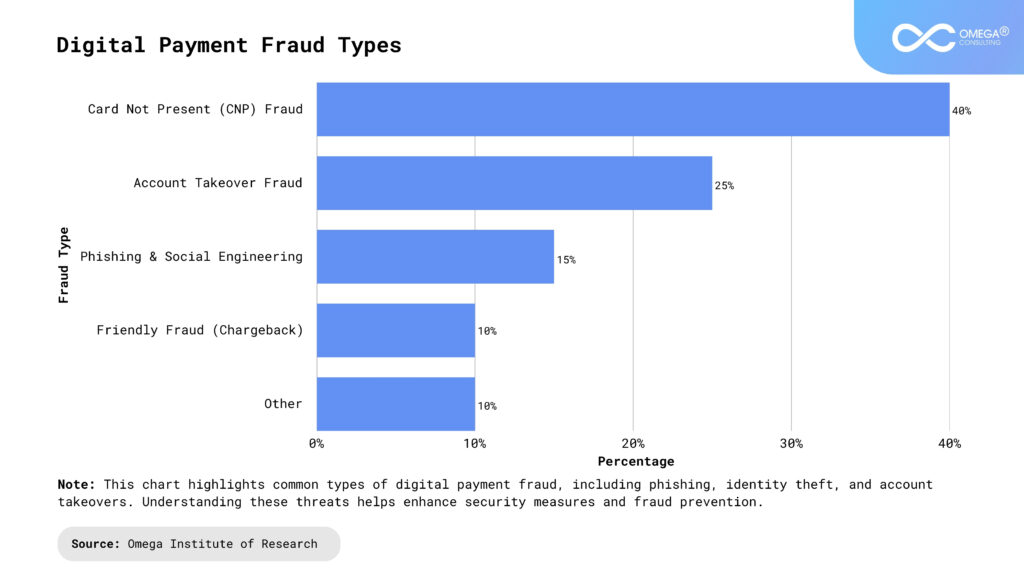

Fraud Detection and Prevention: AI-powered fraud detection systems can analyze vast amounts of transaction data in real time to detect unusual patterns, significantly improving security. By identifying anomalies in transaction behavior, such as sudden large purchases or multiple rapid transactions from different locations, these systems can flag potentially fraudulent activity and prevent financial losses before they occur. Additionally, AI-driven fraud prevention mechanisms can continuously learn from new fraud patterns, reducing false positives and enhancing the accuracy of threat detection. With biometric authentication, behavioral analytics, and predictive analytics, AI is strengthening digital payment security, making transactions safer for both consumers and businesses.

Personalization and Customer Insights: AI is also transforming the customer experience by enabling personalized offers, discounts, and rewards based on individual purchasing behavior. Machine learning algorithms analyze transaction history, browsing patterns, and spending habits to deliver tailored experiences, increasing customer loyalty and enhancing satisfaction. For example, AI-driven recommendation engines in banking apps can suggest relevant financial products, while dynamic pricing models can adjust discounts based on user activity. Additionally, virtual assistants and chatbots powered by AI are enhancing customer service in digital payments by providing instant support, answering queries, and even facilitating transactions through voice or text interactions.

Automation in Payment Processing: Machine learning is being used to automate payment processing, significantly reducing the time and cost associated with manual handling. This technology ensures that payments are processed more accurately and quickly, leading to faster transaction approvals and smoother customer experiences. AI-powered automation also plays a crucial role in dispute resolution, where intelligent systems can analyze transaction records and assist in chargeback processes. Moreover, automated reconciliation and real-time settlement capabilities help businesses manage their cash flow more efficiently. With continuous advancements in AI, payment automation is becoming more intelligent, adaptive, and capable of handling complex transaction flows with minimal human intervention.

Contactless Payments in Transportation and Retail

Contactless payments are particularly impactful in sectors such as transportation and retail, where fast and efficient transactions are essential. As consumers prioritize speed, convenience, and security, businesses in these sectors are increasingly integrating digital and contactless solutions to enhance user experience. The adoption of such technologies not only simplifies transactions but also improves operational efficiency, reduces wait times, and enhances customer satisfaction.

Smart Transportation Systems: Many cities are integrating contactless payments into their public transportation systems, allowing passengers to tap their cards or smartphones to pay for bus, train, or subway fares. This system not only speeds up the boarding process but also reduces the need for physical tickets and cash, making transportation more convenient and accessible. In addition, transport authorities are using AI-driven fare collection systems to optimize pricing strategies and improve transit efficiency. The widespread adoption of contactless payments in transportation is also enabling the development of mobility-as-a-service (MaaS) platforms, which integrate multiple transport options into a single, seamless payment system.

Retail and Hospitality Industry: From large department stores to small coffee shops, retailers are increasingly adopting contactless payment solutions to streamline checkout processes and reduce transaction times. Contactless payment systems also improve the overall customer experience, as shoppers can pay quickly and move on with minimal disruption. Moreover, retailers are integrating loyalty programs and personalized promotions into their contactless payment systems, enhancing customer engagement and retention.

In the hospitality industry, digital payments are helping restaurants and hotels to enhance guest experiences by offering easy payment options and reducing wait times. This is especially valuable in busy, high-volume environments where speed and customer satisfaction are key to success. Additionally, self-service kiosks and mobile check-in/out solutions are further streamlining the hospitality experience, allowing guests to make seamless transactions without standing in long lines.

Sustainability and Digital Payments

As consumers and businesses become more environmentally conscious, digital payments contribute to sustainability in several ways. By eliminating reliance on physical materials and optimizing transaction processes, digital payments help reduce waste, energy consumption, and the carbon footprint of financial transactions. Furthermore, as digital payment ecosystems continue to evolve, sustainable finance initiatives and eco-conscious payment solutions are emerging, aligning financial technology with environmental responsibility.

Reducing Paper Waste: By eliminating the need for paper receipts, banknotes, and checks, digital payments help reduce the environmental impact of traditional financial transactions. Consumers and businesses alike are increasingly choosing digital alternatives to paper-based transactions, aligning their payment methods with eco-friendly values. Many businesses are now offering e-receipts and digital invoicing as standard practices, further reducing paper waste. Additionally, some fintech companies are introducing sustainability-driven initiatives, such as planting trees for every digital transaction, further encouraging the adoption of environmentally friendly payment methods.

Lower Carbon Footprint: The shift toward digital payments can also lower the carbon footprint of financial transactions. With fewer physical materials in circulation and less energy consumed by handling cash, the transition to digital solutions supports a more sustainable and energy-efficient financial ecosystem. Moreover, digital payment infrastructure relies on cloud-based technologies, reducing the need for energy-intensive physical banking infrastructure. As more financial institutions transition to green data centers and adopt carbon-neutral strategies, digital payments will continue to contribute to global sustainability efforts.

The Benefits of Digital Payments and Contactless Solutions

The adoption of digital payments and contactless solutions offers several benefits that are reshaping the financial landscape. Businesses and consumers alike are enjoying enhanced convenience, improved security, and greater accessibility through these digital innovations. Additionally, as digital payment ecosystems grow, emerging technologies are further enhancing efficiency and transparency in financial transactions.

Enhanced Security: One of the biggest concerns with traditional payment methods has always been security. With digital payments, transactions are encrypted and tokenized, meaning sensitive data is not directly transmitted during the payment process. Features like two-factor authentication (2FA) and biometric verification further enhance security, reducing the likelihood of fraud. Additionally, AI-powered fraud detection systems continuously monitor transactions in real-time, identifying and preventing suspicious activities before they can cause harm. As cybersecurity threats evolve, digital payment providers are also adopting advanced cryptographic methods, such as zero-trust security models, to further safeguard transactions.

Global Accessibility: Digital payments transcend geographical boundaries, allowing individuals and businesses to conduct transactions across borders effortlessly. Whether you’re shopping online from a different country or sending money to a friend overseas, digital payment solutions make it possible to transact securely and efficiently, all from the comfort of your device. Furthermore, the rise of multi-currency digital wallets and decentralized finance (DeFi) platforms is making cross-border transactions more affordable and accessible, bypassing traditional banking barriers and costly currency exchange fees. As financial inclusion efforts expand, digital payment solutions are also playing a crucial role in providing unbanked populations with access to financial services.

Reduced Operational Costs: For businesses, the move to digital payments and contactless solutions can result in significant cost savings. Paper-based transactions, manual invoicing, and cash handling are time-consuming and resource-intensive. By embracing digital payments, businesses can streamline their operations, reduce overhead, and improve efficiency. Moreover, digital payments minimize errors associated with manual data entry, reducing financial discrepancies and fraud risks. Many businesses are also integrating AI-driven payment automation systems, enabling faster reconciliation, real-time tracking, and better financial forecasting.

Real-Time Transactions: One of the advantages of digital payments is the speed at which transactions occur. Unlike traditional methods such as bank transfers, which can take days to process, digital payments often settle in real time, providing immediate confirmation to both consumers and businesses. This is particularly beneficial for e-commerce, gig economy workers, and international transactions, where instant access to funds is essential. Furthermore, with the development of real-time payment networks and blockchain-based financial systems, transaction speeds will continue to improve, making digital payments even more efficient.

The Future of Digital Payments and Contactless Solutions

As technology continues to evolve, so too will the landscape of digital payments. The future promises even more innovations that will enhance the user experience and increase the adoption of these solutions. Emerging payment technologies will further integrate with AI, blockchain, and IoT, creating a more seamless, intelligent, and secure financial ecosystem.

Biometric Payments: In the coming years, biometric authentication—such as facial recognition or voice recognition—will likely become more common as a method of authorizing payments. This could further streamline transactions while enhancing security, making it even easier for users to pay without the need for passwords or PIN codes. Many payment providers are already experimenting with palm-vein scanning and retina recognition, paving the way for a future where biometric data replaces traditional authentication methods. Additionally, as wearable technology advances, biometric authentication may become even more integrated into everyday payment processes, further enhancing convenience and security.

Cryptocurrency and Blockchain Integration: With the rise of digital currencies, we can expect to see more businesses and platforms adopting cryptocurrency payments. Blockchain technology will further enhance the transparency and security of these transactions, providing a decentralized and secure way to exchange value. Central banks are also exploring central bank digital currencies (CBDCs), which could redefine digital transactions on a global scale. Moreover, smart contracts and decentralized applications (dApps) will enable programmable financial transactions, automating payments and reducing reliance on intermediaries. The integration of blockchain in financial systems will likely lead to faster settlements, lower fees, and greater financial inclusion.

Internet of Things (IoT) Integration: The Internet of Things (IoT) will play a significant role in the evolution of digital payments. Smart devices, from wearables to connected cars, could become payment hubs, enabling users to make transactions simply by interacting with their surroundings. For example, self-driving cars could autonomously pay for tolls and charging stations, while smart refrigerators could reorder groceries and make payments automatically. The seamless integration of IoT and digital payments will enhance automation, personalization, and efficiency, transforming the way people and businesses manage transactions in their daily lives.

Conclusion

Contactless solutions and digital payments are not just shaping the future—they are already transforming the way we live, work, and interact with money. As these technologies evolve, they will unlock even greater opportunities for consumers and businesses, offering faster transactions, enhanced security, and unmatched convenience. The integration of AI, blockchain, and IoT will further streamline payment processes, ensuring seamless and secure transactions. With regulatory frameworks adapting to the digital economy, financial institutions and fintech companies will continue driving innovation while maintaining compliance. As the shift toward a cashless society accelerates, businesses that embrace digital payment advancements will gain a competitive edge, providing frictionless experiences for customers. Prioritizing accessibility, security, and sustainability, digital payments will revolutionize global commerce, empowering individuals and organizations to transact with confidence in an increasingly interconnected world. To learn how Omega can help you navigate this digital transformation and implement cutting-edge payment solutions, contact us today and take your business to the next level.

- https://www.forbes.com/councils/forbestechcouncil/2024/09/04/the-rise-of-contactless-payments-how-its-disrupting-the-way-payments-are-made/

- https://neontri.com/blog/digital-payment-technologies/

- https://business.bankofamerica.com/resources/benefits-of-digital-payments.html

- https://teliolabs.com/the-future-of-digital-payments-contactless-mobile-and-beyond/

- https://www.netsuite.com/portal/resource/articles/ecommerce/contactless-payment.shtml

Subscribe

Select topics and stay current with our latest insights

- Functions