- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Retail

- By Omega Team

Cryptocurrencies work by storing all transactions from the inception of the currency on a public ledger. The ledger uses cryptographic techniques to ensure that records are accurate and all owner’s identities are encrypted. Cryptocurrency owners each have a “digital wallet” and it is the job of the ledger to ensure that those wallets show an accurate spendable balance. It also checks transactions to ensure that the owner is only spending their own wallet balance. Cryptocurrencies give customers another finance option. With cryptocurrencies, not only will people not need to interact with banks the same way they do now, they’ll also be able to avoid bank fees.

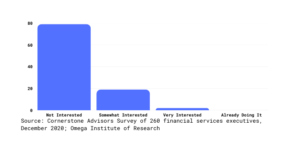

According to a study conducted by the Association of Certified Anti-Money Laundering Specialists (ACAMS) and the U.K.’s Royal United Services Institute, nearly 63% of respondents who work in the banking industry perceive cryptocurrency as a risk rather than an opportunity. Bank of America Corp. listed cryptocurrencies among the risk factors that could impact the bank’s competitiveness and reduce its revenues and profits. The disclosure was followed by a similar message from JPMorgan Chase & Co, whose CEO has previously called bitcoin a “fraud.” A Cornerstone Advisors survey of senior bank and credit union executives found that eight in 10 financial institutions have no interest in offering cryptocurrency investing services to their customers—and just 2% said they were “very” interested.

Figure 1: Financial Institution providing Cryptocurrency

Decentralized Nature

Crypto assets were created as an alternative to traditional banking infrastructure that don’t need an intermediary and aren’t tethered to the capacity of a centralized government, bank, or agency. Instead of relying on centralized intermediaries in these transactions, the trust is placed in the blockchain code and the distributed nature of the blockchain.

The decentralized nature of the currency is seen to undermine the authority of central banks, leaving some to believe that they won’t be needed anymore, or they’ll be unable to control the money supply.

AML/KYC Concerns

Cryptocurrencies allow for peer-to-peer transactions without a regulated intermediary, giving the user the ability to easily transfer funds quickly without having to pay transaction fees. Instead of identifying the transaction by an individual bank account through a financial institution, transactions are simply linked to the transaction ID on the blockchain.

This type of pseudonymity worries many banks who are concerned about the lack of anti-money laundering (AML) and know your customer (KYC) regulations surrounding digital currency transactions. Oftentimes, banks are under the impression that cryptocurrency transactions can’t be tracked for AML and KYC considerations, which could lead to illegal activity and scams on the network.

Volatility

The price of cryptocurrencies has generally been volatile over their short life. Historically, the price hasn’t been stable. It is easily believed that cryptocurrencies might not be a stable investment over time.

The Banks Strategies to Cryptocurrencies

To avoid being left behind, banks need to find a way to embrace this technology and treat it as a friend rather than an enemy. Cryptocurrency adoption could streamline, enhance, and upgrade financial services, and there are plenty of recent industry advancements that can ease banks’ concerns around the risks and instead let them recognize the potential benefits.

Regulatory agency Office of the Comptroller of the Currency (OCC) believes that banks could safely and effectively hold either the cryptocurrency itself, or the key to access crypto on a personal digital wallet for its customers.

In 2019, the Financial Crimes Enforcement Network’s (FinCEN) determined that any cryptocurrency transactions and custody services conducted through crypto entities that are considered money service businesses must still abide by AML/KYC regulations. This will help avoid malicious transactions, illegal activity, or scams using these platforms. These regulations could help banks and larger financial institutions conduct due diligence on customers involved in crypto transactions, further diminishing their anxieties about the risks that these transactions pose.

Banks can help mitigate the security concerns of cryptocurrency holders. Hacking of personal wallets and exchanges is a concern for many holders. Well-established banks could help secure digital currencies from theft or hacks, putting clients’ minds at ease. Bringing cryptocurrency under bank supervision could help diminish criminal activity or the appearance to outsiders that cryptocurrency transactions aren’t secure.

Banks can also utilize public Blockchain to speed up their payment processes. Blockchain technology provides a faster and less expensive alternative to clearing houses when processing transactions. The clearing and settlements could occur at a much faster rate if banks utilized blockchain technology.

Countries’ Reaction to Cryptocurrencies

Reactions towards cryptocurrencies vary from country to country. Some are completely against it, while others believe it could provide a wealth of opportunity.

Both China and Vietnam have banned cryptocurrencies. Vietnam’s state bank said that Bitcoin and other virtual currencies weren’t accepted as a lawful means of payment. The statement then went on to say that using cryptocurrencies can result in huge number of fines. A Chinese government clampdown on bitcoin also had once caused its price to fall sharply.

British banks have been reported to shun companies handling cryptocurrencies, with the Bank of England having said that, “If a central bank were to issue a digital currency, it would have wide-ranging implications for monetary policy and financial stability.” However, despite this, the bank has also said they’re researching whether a central bank-issued currency could be feasible.

On the other hand, Australia doesn’t think this approach is necessary. The Head of Payments at the Reserve Bank of Australia thinks instead of trying to regulate cryptocurrencies, perhaps it would be more beneficial to regulate the industry aiding it. Cryptocurrency and blockchain could actually provide banks with potential opportunities.

While governments around the world have been resistant to accepting cryptocurrencies as legitimate payment systems, they aren’t opposed to the underlying Blockchain technologies that run all of these currencies. Enter Central Bank Digital Currencies (CBDCs). It is reported that Central banks in Europe, US, China, India and more have been working on CBDCs.

CBDCs are digital versions of the currencies such as digital US dollar and digital Chinese Yuan. They have great importance in the future, with respect to environmental concerns, curbing bank frauds and more. They are also Stablecoins, meaning their value remains stable and doesn’t fluctuate the way cryptocurrencies do. They are backed by federal banks, instead of consumer sentiments. They also give the government great powers of surveillance.

Can Cryptocurrency become future banks?

Failure to adhere to traditional financial practices could eventually hinder the longevity of the venture. Perhaps a middle ground may be reached: banks need to do more to understand and accommodate the blockchain technology behind cryptocurrency, and the creators of new cryptocurrencies need to consider and appreciate the importance of traditional banking practices.

However, banks are more in need of change to cope with the rapid growth of the market of cryptocurrencies. Despite general reservations within the industry when it comes to the effect of cryptocurrencies, six banks are working together to create their own. These include: HSBC, Barclays, State Street, Canadian Imperial Bank of Commerce, Credit Suisse, and MUFG. Perhaps they’ll be able to harness the blockchain technology in such a way that cryptocurrencies are regulated, removing concerns about criminal activity.

Subscribe

Select topics and stay current with our latest insights

- Functions