- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Technology

- By Omega Team

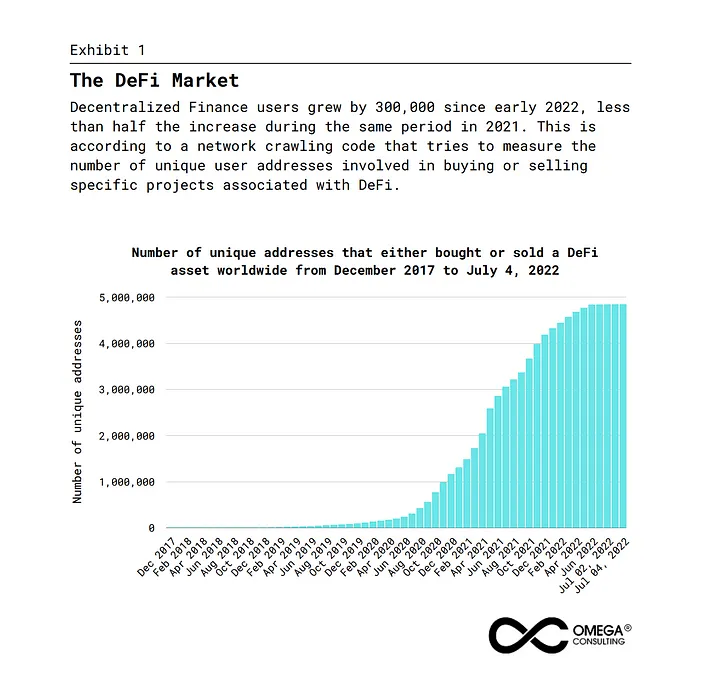

Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services. It uses blockchain, which is a kind of ledger that tracks all transactions on a given financial platform. DeFi is enabled by smart contracts, which are executable codes that can store cryptocurrencies and interact with the blockchain according to its rules. These smart contracts automatically execute transactions among participants. When the contract’s conditions are fulfilled, they self-execute their set of instructions.

Future Trends for Organizations

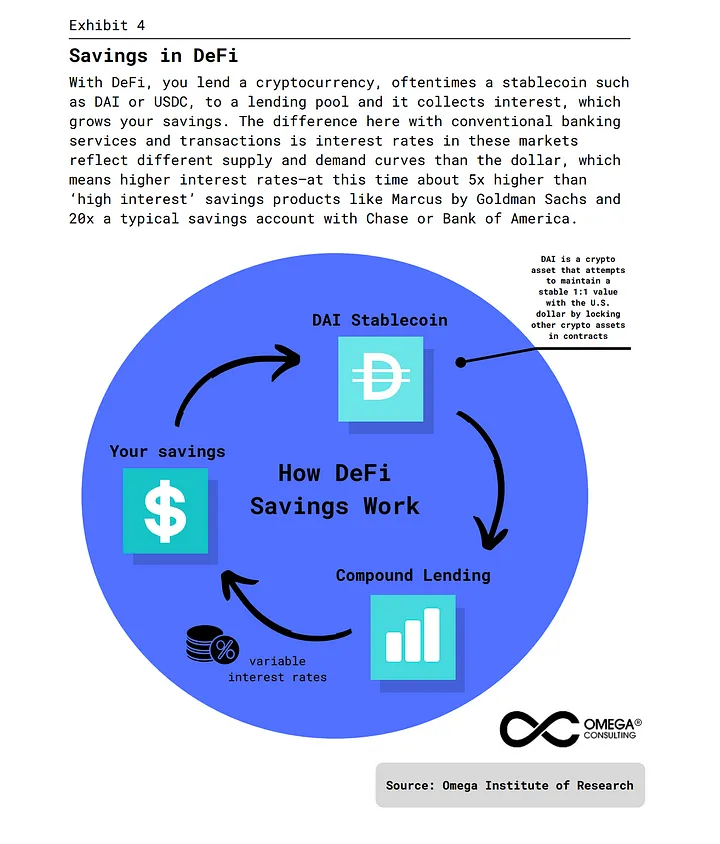

DeFi is certainly making an impact on traditional finance and is giving a variety of opportunities to businesses. Some ways in which there can be exposure to this emerging sector are: DeFi offers the opportunity of yield for idle cash reserves: some businesses are already experimenting by investing in Bitcoin as part of their corporate treasury operations.

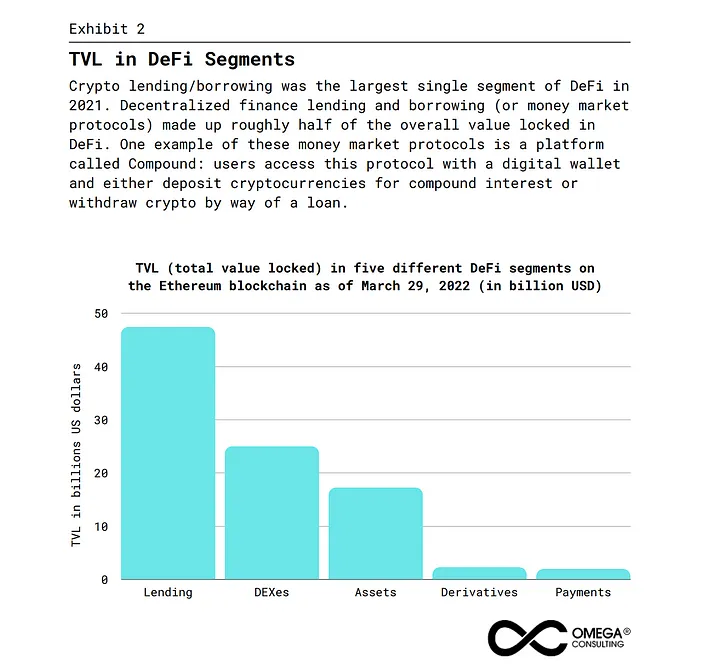

However, DeFi is much broader and can offer attractive yield opportunities. DeFi stablecoin capital markets routinely generate yields between 4% and 8% based on demand for stable digital assets. In particular, DeFi applications with the highest Total Value Locked (TVL) figures, typically in the tens of billions, offer a good mix of technical security, thoughtful protocol design, and return on investment. To finance their operations, businesses will access borrowing and lending arrangements with ease in DeFi applications: provides a great option for businesses in developing markets, such as Latin America, India, and Africa, where small and medium-sized enterprises often lack proper banking infrastructure to meet their financial needs.

Adopting blockchain technology at this early stage will put businesses in a position to be one step ahead of the competition: Blockchain technology can automate processes, remove unnecessary intermediaries, cut costs, ensure a high degree of transparency and security, reduce human errors, and improve user experience. DeFi is a good way for businesses to get into blockchain, as integrating the technology for processes inside them can be difficult and can take upon extensive resources. Getting a head start on DeFi, smart contracts, and blockchain technology is ideal for businesses to prepare for the continued accelerated growth of the digital economy over the coming years.

ReFi

Reimagined Finance (ReFi) is a DeFi-as-a-Service platform that is on a mission to make farming rewards accessible to all. ReImagined Finance is about reimagining your relationship with your personal finances. ReFi’s purpose is to bring yield farming to all levels of investors across all socioeconomic levels.

ReFi values transparency, innovation, and community. ReFi vows to keep investors’ needs at the forefront of the business. In fact, the whole ethos being decentralized finance (DeFi) is to be your own bank. ReFi makes this process truly democratic, by taking out the friction involved in actively participating in DeFi Markets.They do a very simple concept: Investors give us Ethereum, they use it to “farm” on multiple blockchains, extract yield, and then pass it back seamlessly to their investors. All of this is available at the click of a button. Investors buy the ReFi token which gives them proportional access to the cash flow generated by the Portfolio of Assets (which currently stands at $3,000,000).

To date, they have paid over $4,500,000 of distributions back to their holders. No other FaaS provider comes anywhere near this close in terms of returns generated for its holders. They have also pioneered several pillars that have now been adopted across the industry. These include daily financial reporting, full transparency on positions, a podcast with distinguished guests from across the DeFi space, in-depth articles about risk management and deep relationships with DeFi protocols.

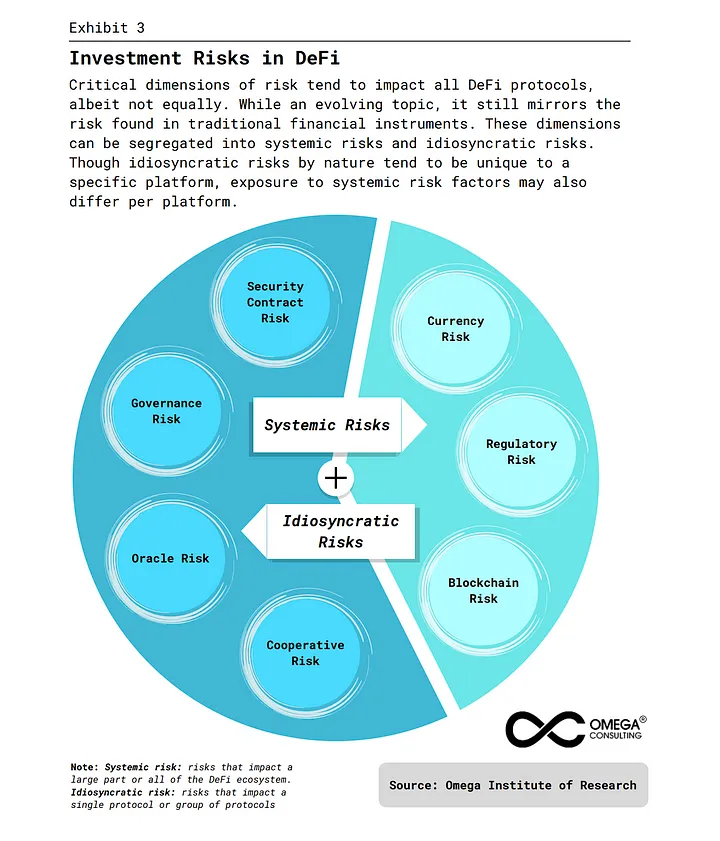

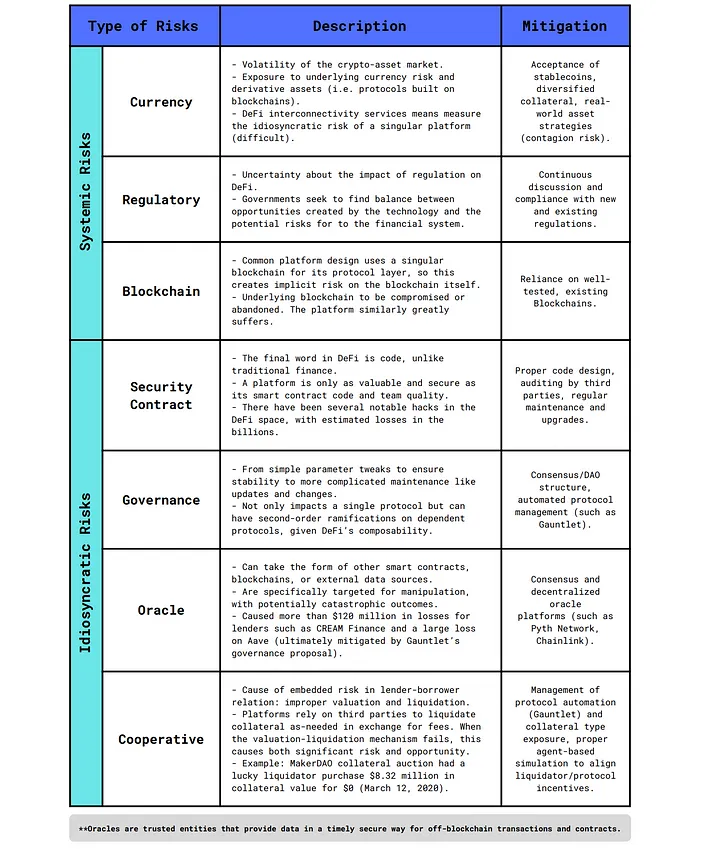

Below is a comprehensive table that indicates that DeFi Investment Risks from the Omega Institute of Research

Future Outlook

DeFi has a long road ahead, especially when it comes to uptake by the general public. It provides many benefits such as total control of your money in a secure digital wallet, instead of keeping it in a bank. Also, anyone with an internet connection can use it without needing approval and you can transfer funds in seconds and minutes.

Investors will soon have more independence, which will allow them to deploy assets in creative ways that seem impossible today such as with the development of DApps, DeFi exchange and DeFi wallets. This also carries big implications for the big data sector as it matures to enable new ways to commodify data.

Subscribe

Select topics and stay current with our latest insights

- Functions