- Industries

Industries

- Functions

Functions

- Insights

Insights

- Careers

Careers

- About Us

- Retail

- By Omega Team

Introduction

With the development and popularization of high-tech devices and applications, many jobs have changed. Businesses tend to cut costs and increase profits, including retail stores do. Combined with the development of various computer technologies, the cashier’s job can be completely replaced. Lets see how it works in Amazon’s physical stores.

Amazon’s Staff-Free Grocery Store

Amazon Go is a chain of convenience stores now operated in the United States and the United Kingdom by online retailer Amazon. In 2016, Amazon Go unveiled plans to open 2,000 stores within a decade. A Beta version was launched only opened to employees in January 2017 and opened to the public in October of that year.

As of 2021 March, Seattle-based Amazon currently has 27 of the compact Amazon Go convenience stores, including eight in Manhattan, seven in Chicago, six in Seattle and five in San Francisco.

How Does It Work?

The Amazon Go store is only available for mobile apps. On the mobile app, consumers can easily locate local stores, special offers, receipts and more. It also has a PIN and fingerprint unlock system to ensure security.Consumers simply scan the QR code to enter the store, and the system automatically identifies your account and tracks your movements in the store. You can also scan your friends and family in, and the items they pick up will be credited to your

account.Amazon GO stores monitor everything from above and around you. It’s called a virtual shopping cart, and it uses “Just Walk Out” technology that includes deep learning algorithms, computer vision and sensor fusion. It can catch, analyze and react to human activities. You’re free to take what you want in the store. The system always tracks and automatically updates your virtual shopping cart. When you change your mind, simply put the item back. There are weight sensors on shelves that track when items are removed. When you finish shopping and walk out of the store, the items are automatically billed and charged to your account. There is no need to register or wait in line in this shopping process.

Costumer’s View

Amazon Go still has a lot of room to grow because of the overall positive experience it brings to customers, although it hasn’t been popularized yet. Of those polled by Piplsay, only 28% said they’ve actually gone to an Amazon Go, and 20% reported that they never heard of the store. However, 54% of consumers who visited Amazon Go described their experience as “excellent,” and 35% thought it was “good”.Meanwhile, 57% said they would be “excited” if an Amazon Go or similar cashier-less, artificial intelligence-driven store opened in their neighborhood. Of the 26% not interested in having an Amazon Go in their area, half said they prefer regular stores and half favor online shopping. Another 17% said they’re “not sure” about the Amazon Go concept.

Backed by its good business performance, Amazon Go’s expansion is inevitable. Amazon plans to open 3,000 stores in the next few years, according to a 2018 Bloomberg report. Based on RBC Capital Market’s 2019 analysis, the average annual sales volume of each Amazon Go is $1.5 million. In other words, if Amazon Go expands as planned, it could become a $4.5 billion business, potentially a major business for Amazon. Published reports also have said Amazon Go could pop up in new types of locations such as airports and expand to thousands of similar sites. Piplsay asked customers in the context of Amazon opening thousands of stores if such a scenario would present a competitive challenge to big-box chains such as Walmart and Kroger. As shown in the figure, more than half of the respondents agree that Amazon Go would be a threat if it undergoes a major expansion. Still, 26% of survey respondents believe Amazon Go doesn’t stand as a threat to retailers like Walmart and Kroger. 15% note that Walmart and other large operators also will continue to innovate, and 11% think Walmart and other major chains are already too big for Amazon Go to present a competitive threat.

The Controversy

The expansion of Amazon Go and its revolutionary impact on the retail industry has brought convenience to consumers to a large extent, but there are many controversies surrounding it. The most important point is that it is obvious that such stores will greatly reduce employment in the industry. Many employees who work in supermarkets now may lose their jobs forever. These arguments have been raised since Amazon Go launched. Although Amazon Go is not expanding as aggressively as it had planned, the challenge of unemployment is one that governments and businesses should be concerned about.The Great Depression had 25 percent of the population out of work. What happens when that number doubles? We have never experienced such job elimination, but it seems to be the trend as automation and artificial intelligence are introduced into various fields to replace human labor.

The civilian labor force participation rate is about 63 percent, according to the Bureau of Labor Statistics. That’s 201 million people. Some academics have predicted that 40 percent of the jobs in this country could vanish within 20 years. That would mean 80.4 million people would be permanently out of work.

The Potential of Staff-Free Store in China

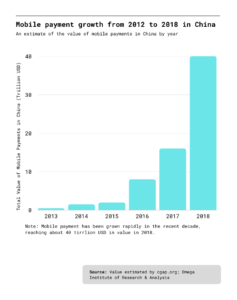

China is systematically and rapidly doing away with paper money and coins, and people in major Chinese cities are using their smartphones to pay for just about everything. Even buskers playing on the streets of a number of Chinese cities have put up boards with QR codes so that passers-by can easily transfer them tips directly. The rapid rollout of cash and staff-free stores in China has been made possible by the widespread use of mobile payments, which were 50 times greater in China than those in the US, according to market data.

Unlike the introduction of Uber and Airbnb, which brought huge changes to China’s hotel and taxi industries, brick-and-mortar retail is undergoing huge technological changes in China and the US. But some attempts are underway.

Alibaba, the Chinese online retail and online payments giant, won’t miss the opportunity. It launched Tao Café, its first cashier-less cafe, in Hangzhou, the capital of east China’s Zhejiang province, drawing queues of customers on the opening weekend. To enter and make a purchase, shoppers required only a smartphone with Alibaba’s Taobao e-commerce app. The café

uses facial and voice recognition systems to track purchases and the system are able to automatically generate bills as soon as customers pass through a gate that can identify them with biometric technology.Similar to Amazon Go, BingoBox in China is already several steps ahead on the unmanned retail front, with plans to expand internationally. The Chinese store, which consumers enter by scanning a QR code at the door, has already been installed in more than 300 locations in 30 cities in China.

In addition to local companies, Wheelys from Sweden was attracted by China’s huge population and the popularity of mobile payments. Wheelys cofounders decided to test in China rather than Sweden in part because of its large market and mobile payment value.

Exhibit 1. Consumer results from a nationwide survey of public opinion on Amazon Go

Entering the Chinese market brings unique challenges, such as its thriving counterfeiting industry. The Chinese counterfeit industry costs foreign firms an estimated $20 billion a year in lost profit, which works with international companies to root out and help shut down counterfeiters.

Exhibit 2. Mobile payment growth from 2012 to 2018 in China

Alibaba’s founder Jack Ma says that China’s weak laws are part of the problem: the Chinese government’s preferential policies and regulations to restrict market access by foreign companies and the lack of sophisticated IP protection give Chinese companies a home advantage to create copies.

Sweden’s Staff-Free Store in Rural Area

Unlike the experience of China and the United States focusing on the market in big cities, Sweden’s staff-free stores are aimed at rural markets.

Hummelsta is a town of 1000 people, surrounded by pine forest. It hasn’t had any local shops for a decade. Since December 2020, a red wooden container, about the size of a mobile home, has offered a lifeline. It’s a mini supermarket that locals can access round-the-clock.

These high-tech, unstaffed stores are tiny, and open 24/7 to help residents get their groceries in rural Sweden. There’s a wide assortment of groceries available, from fresh fruit and vegetables to Swedish household staples like frozen meatballs, crispbreads and wafer bars. But there are no staff or checkouts here.

The store is part of the Lifvs chain, a Stockholm-based start-up that launched in 2018 with the goal of returning stores to remote rural locations where shops had closed down because they’d struggled to stay profitable. Using a container rather than an actual storefront gives Lifvs the flexibility to shift locations if foot traffic isn’t good. Lifvs had opened 20 new locations in rural areas since March 2020.

The co-founder and COO of Lifv Daniel Lundh said that he launched this company in 2018 because he wanted to solve food deserts – an area that has limited access to fresh food in rural Sweden.

Conclusion

Many stores have actually set up automatic payment devices to divert customers at the waiting line. The introduction of AI technology can even eliminate steps such as scanning and payment. The technology Amazon Go first developed simplifies the process of shopping in physical stores to the extreme. There is no doubt that the savings that staff-free stores bring will make them more popular worldwide in the future.

Subscribe

Select topics and stay current with our latest insights

- Functions